Unitree Robotics Robots

Jump to Section:

- What is Unitree Robotics?

- What do experts think about Unitree Robotics 3D Printers?

- Why buy Unitree Robotics?

- Which Unitree robot should I buy?

- What software can I use with Unitree robots?

- What parts and accessories are available with the Unitree robots?

- What is the Unitree Robotics' warranty policy?

What is Unitree Robotics?

Unitree Robotics stands at the forefront of the global robotics field, pioneering advancements in legged and humanoid robotics of the future world. The company is distinguished by its industrial leadership, commitment to technical innovation, and excellence in both consumer technology and industrial applications. In recent years, its high-performance quadruped robots have demonstrated their capabilities on the Super Bowl and Asian Games. With a portfolio boasting over 150 global patents, Unitree Robotics is dedicated to reshaping the world through cutting-edge robotic solutions.

As a world renowned robotics company, Unitree Robotics is trusted by leading brands and research institutions. Its high-performance solutions have garnered attention from esteemed names like Google, Amazon, NVIDIA, and research powerhouses such as the Massachusetts Institute of Technology and Stanford University.

Unitree Robotics authorized Top 3D Shop as its value-added reseller in 2020. Top 3D Shop has sold over 100+ units manufactured by Unitree and successfully completed 100% of the received client's support tickets. Customers who purchase directly through Top 3D Shop receive local customer support from our technical center in California, USA.

What do experts think about Unitree Robotics?

In the years we've been working with Unitree Robotics, we've been consistently blown away by their unparalleled technical innovation. What sets Unitree Robotics apart in our portfolio is their bold leap into the world of quadruped and humanoid robots, a stark contrast to the more common drone and stationary robotics offerings. We'd certainly recommend it to businesses pioneering in automation, safety, and efficiency who aren't afraid to sprint alongside technology on all fours—or two. – David Mosley, 3D Solutions Specialist at Top 3D Shop

Why buy Unitree Robotics?

Pioneering Technology: Unitree Robotics is recognized for its industrial leadership and groundbreaking advancements in redefining a concept of a quadruped robot. The Unitree Go2 model exemplifies this with its self-developed 4D LIDAR L1 and big model GPT empowerment. Its capacity for complex movements, such as jumping and obstacle navigation, leverages advanced motion control algorithms, ensuring unparalleled functionality in various applications.

Industrial-Grade Performance: The Unitree B2 quadruped robot can run at 6 m/s, making it the fastest in its class. It's designed for superior terrain adaptability, capable of effortlessly climbing stairs, and maintains stability on uneven surfaces. The B2’s joint performance has seen a 170% increase, providing the maximum joint torque of 360 N.m, which translates to increased flexibility and stability.

High-Level Customization and Control: Unitree's Z1 robotic arm introduces an exceptional degree of dexterity and precision. The model's compact, lightweight design does not compromise on strength, offering sufficient payload and accuracy. The Z1 robot supports joint force control with collision protection. Moreover, it features an open programming interface that facilitates quick integration and manipulation.

Multifunctional Designs: The Aliengo quadruped robot integrates a multi-view depth sensing vision system, athletic performance, and extensive external interfaces for expanded functionality. It is designed for complex terrain adaptation. The robot showcases significant power and load capacity, which makes it suitable for a wide range of industrial applications.

Comprehensive Ecosystem and Support: Unitree Robotics emphasizes an ecosystem approach, integrating advanced sensors, high-performance computing, and user-friendly interfaces. This ensures that Unitree solutions are not only technologically advanced compared to its counterparts but also practical and accessible for developers and users.

Which Unitree robot should I buy?

Here is a list of the major Unitree Robotics robot series to choose from:

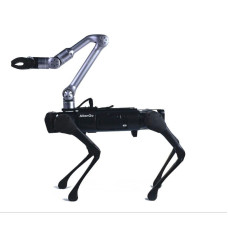

Unitree Aliengo

Unitree's Aliengo is a multifunctional quadruped robot built for industrial applications. Weighing 21.5 kg and supporting a load of 13 kg, Aliengo is also capable of precise navigation and obstacle avoidance. With a maximum speed exceeding 1.5 m/s and endurance between 2.5 to 4.6 hours, it's designed for high mobility and flexibility in challenging surroundings. Aliengo's advanced features, including real-time HD video transmission and gesture recognition, make it a leading choice for security patrols, exploration, and rescue operations.

Unitree B series

Unitree's B-series epitomizes industrial-grade strength, versatility, and innovation. The B2 quadruped robot is a powerhouse, blazing trails with a speed of 6 m/s and boasting exceptional adaptability to diverse terrains. The B2-W, with its interchangeable wheels and legs, pushes efficiency further: with similar specifications, it can achieve speeds up to 20 km/h and carry loads across 50 km. The B1 quadruped robot, known for its IP68 waterproof rating, tackles challenging environments with ease. Climbing slopes just like walking on the ground, it's ideal for agriculture, security, and rescue missions.

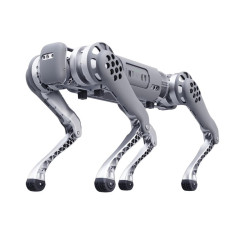

Unitree Go series

The Unitree Go series—Go2 and Go1—are bionic high-performance quadruped robots that blend agility, intelligence, and cutting-edge technology. Unitree Go2, equipped with a superior 4D LIDAR and featuring big model GPT empowerment, excels in all-terrain adaptability. The lighter Go1 with a fast-charging battery dazzles with its speed and mobility. Both models boast advanced sensing systems, high-speed capabilities (up to 17 km/h for Go1), and enhanced customization. From performing complex tasks to being a futuristic companion, the Unitree Go series is at the forefront of integrating robotics into daily life. Each model, a new creature of embodied AI, is ready to explore the future world.

Unitree H1

The Unitree H1, the company's half a year achievement, is the first general-purpose humanoid robot. This new creature of emobodied AI revolutionizes the field with its ability to walk and run with a world record speed of up to 3.3 m/s. The Unitree H1 humanoid robot combines advanced powertrain technology with 360° depth perception for unmatched mobility and flexibility. With a battery capacity of 864Wh, maximum joint torque of 360N.m, and a high torque density of 189N.m/Kg, Unitree H1 is intended for use in industrial applications, emergency response, and more. Being the highest-power-performance robot of its counterparts with similar specifications, it represents a significant leap in humanoid robotics field.

Unitree robotic arms

Unitree's Z1 and D1-T exemplify cutting-edge precision and flexibility. The Z1 is a compact, dexterous robotic arm that features 6 degrees of freedom (DoF), a reach of 740 mm, and supporting payloads up to 3 kg. It's known for its high performance, precise control, lightweight design, and open programming interface. The D1-T advances these capabilities further, offering ultra-precision in force control, a gripper for enhanced spatial movement, and a payload capacity of 500 g. Both arms are tailored for integrating into complex environments, from educational platforms to industrial applications.

Case Studies

Frequently Asked Questions

What software can I use with Unitree robots?

Users can utilize a suite of open-source software tools and SDKs. These include reinforcement learning routines, ROS simulation packages, and SDK packages for real-environment development. There's also support for ROS2, motor SDKs for communication protocol encapsulation, and 4D Lidar L1 SDKs for secondary development and SLAM.

What parts and accessories are available with the Unitree robots?

The company offers advanced motors, high-capacity batteries, LiDAR for environment mapping, waterproof joints for IP68 protection, fast chargers, remote controls for long-distance operation, and sensitive foot ends for precise control.

What is the Unitree Robotics' warranty policy?

Unitree Robotics' warranty covers maintenance or parts replacement under certain conditions. It excludes coverage for damages from improper use, non-original accessories, unauthorized modifications, and misuse as outlined in the product brochure. Read the full terms here: https://www.unitree.com/terms/